Bank Altitude™ Reserve Visa Infinite® card can earn 3X points when they make eligible mobile wallet purchases. For example, consumers with the Apple Card can earn 3% cash back when using Apple Pay at select stores and 2% cash back on all other Apple Pay purchases.

Some issuers may limit the number of transactions displayed on mobile wallets.

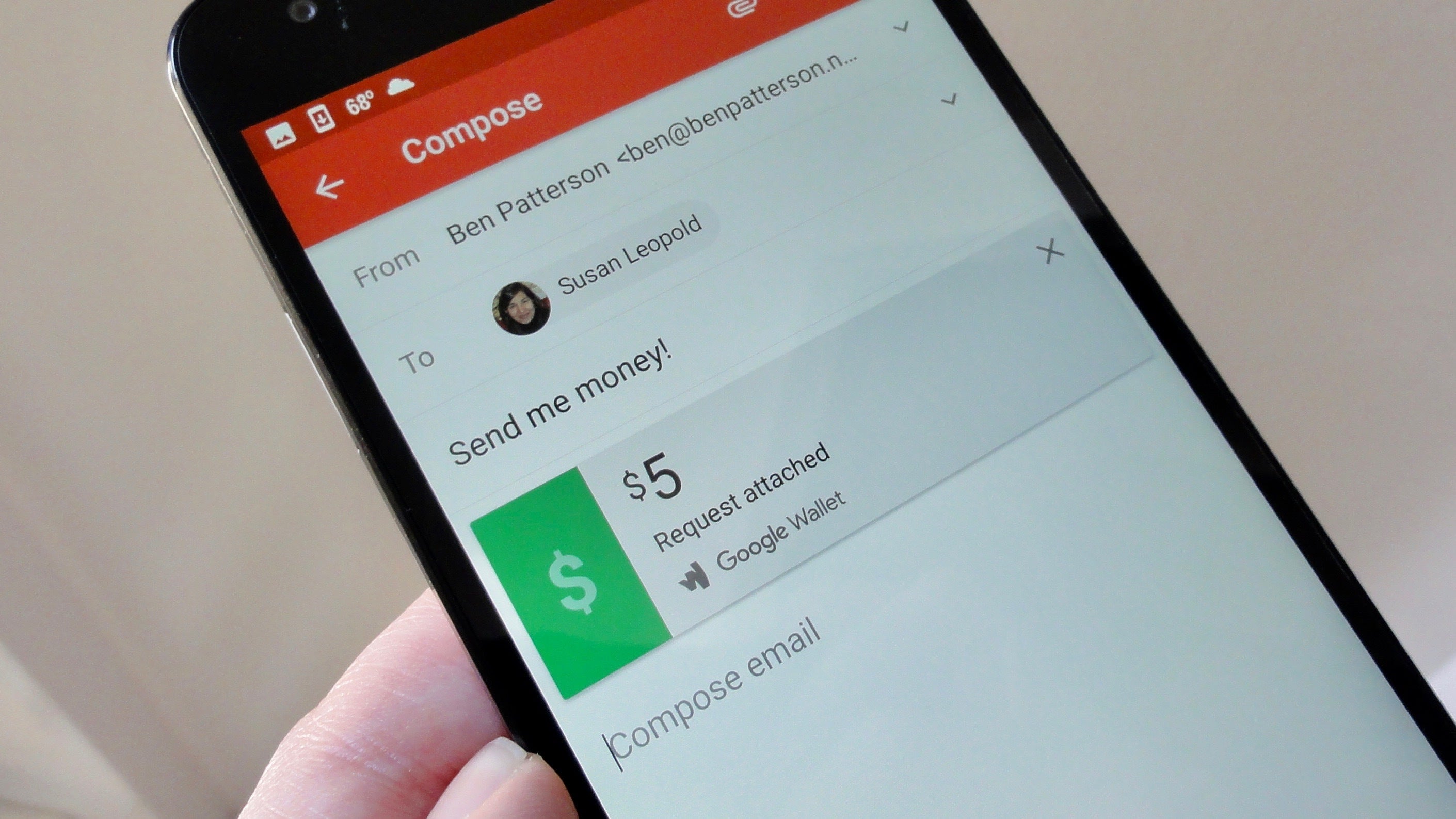

The most common mobile wallets are Google Pay, Samsung Pay and Apple Pay, and all come pre-installed on the devices on which they can be used. If you’re debating whether it’s time to start using a mobile wallet, here’s a guide to how they work, what features they offer and how secure payments are. WorldPay predicts that fewer consumers will choose cash as their payment method at point-of-sale transactions by 2025, decreasing from 11.4% in 2021 to 5.7% by 2025.

The study suggests that while the majority of consumers will still prefer using old-fashioned debit and credit cards for their purchases in 2025, the runner up will likely be mobile wallets. If you have considered ditching your old-fashioned plastic credit card and switching to a mobile wallet but haven’t yet, you have plenty of company.Īccording to WorldPay’s Global Payments Report 2022, the use of mobile wallets to make purchases in stores in the U.S.

0 kommentar(er)

0 kommentar(er)